How Do Dividends Affect the Balance Sheet?

Dividends are often paid quarterly, however may be paid yearly or semi-annually. Retained earnings, an fairness account discovered on the corporate’s stability sheet, is reduced at the time the dividends are declared, and never on the time the dividends are paid. When a dividend is later paid to shareholders, debit the Dividends Payable account and credit the Cash account, thereby reducing both money and the offsetting liability. However, the scenario is totally different for shareholders of cumulative most well-liked inventory. These shareholders personal inventory that stipulates that missed dividend funds must be paid out to them first earlier than shareholders of other classes of inventory can receive their dividend funds.

How do you account for dividends paid?

The cash dividend affects the cash and shareholders‘ equity accounts primarily. There is no separate balance sheet account for dividends after they are paid. However, after the dividend declaration and before the actual payment, the company records a liability to its shareholders in the dividend payable account.

Who truly declares a dividend?

Whether you’re paying dividends in money or inventory, you’ll wish to recognize and report them based on the date the corporate declares them. Debit the retained earnings account for the whole quantity of the dividends that shall be paid out.

What accounts are affected when dividends are paid?

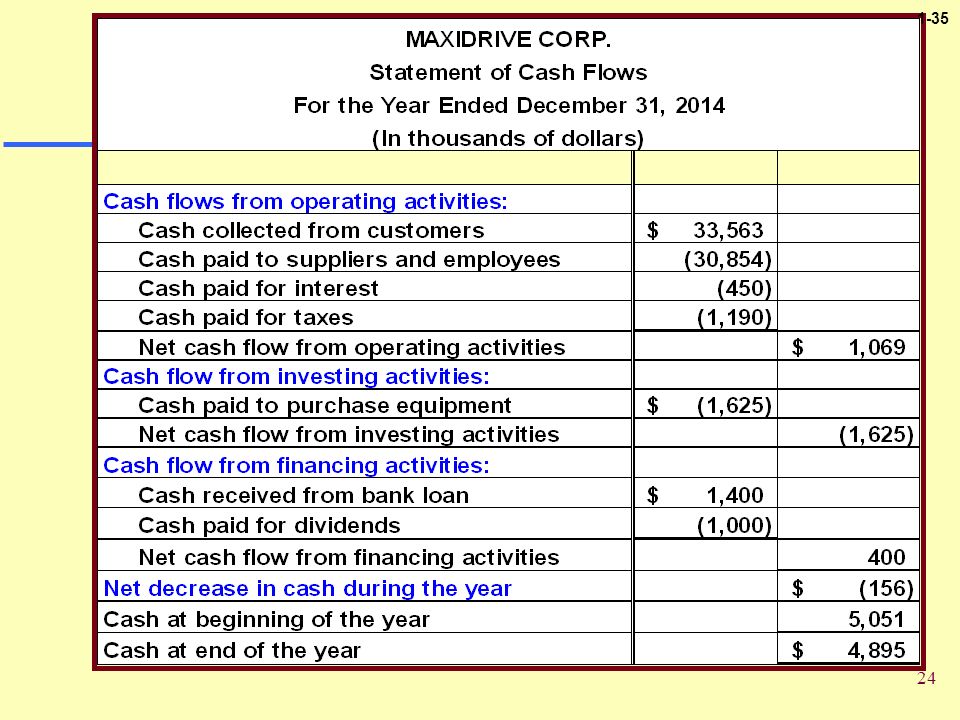

When the dividends are paid, the effect on the balance sheet is a decrease in the company’s retained earnings and its cash balance. In other words, retained earnings and cash are reduced by the total value of the dividend.

Then you’ll be able to credit score the dividends payable account on the date of declaration. When the company really pays the dividend, enter the date of cost. After the dividends are paid, the dividend payable is reversed and is no longer present on the liability side of the steadiness sheet. When the dividends are paid, the impact on the steadiness sheet is a decrease within the company’s retained earningsand its money steadiness. Retained earnings are listed within the shareholders‘ fairness section of the balance sheet.

How Dividends Affect Stockholder Equity

The cash dividend impacts the cash and shareholders‘ equity accounts primarily. There is no separate steadiness sheet account for dividends after they’re paid.

When the dividends are paid, the effect on the stability sheet is a decrease within the firm’s retained earnings and its money stability. In other words, retained earnings and money are decreased by the whole worth of the dividend. Dividends impact the shareholders‘ equity part of the company balance sheet– the retained earnings, in particular. Retained earnings are the amount of cash a company has left over in spite of everything of its obligations have been paid. Retained earnings are sometimes used for reinvesting in the company, paying dividends, or paying down debt.

Facts About Dividends

Cash and inventory dividends influence different accounts on the company books, but each start with a debit to the „Retained Earnings“ account on the date the dividend is asserted. For a money dividend, a liability account, „Dividends Payable,“ is credited. When funds are actually issued to stockholders, a second set of bookkeeping entries follows. The „Cash“ account is credited for the funds removed and precise paid out to stockholders, and „Dividends Payable“ is credited.

- Upon fee, the company debits the dividends payable account and credits the cash account, thereby eliminating the liability by drawing down money.

- While the accounting equation is easy, many various accounts and funds can comprise assets and liabilities at a enterprise.

- Examples embody accounts devoted to workplace supplies, depreciation expense, prepaid insurance coverage and utilities.

- For example, on March 1, the board of directors of ABC International declares a $1 dividend to the holders of the company’s a hundred and fifty,000 excellent shares of frequent inventory, to be paid on July 31.

- Shareholders‘ equity is determined by adding retained earnings and common inventory.

- This stays a legal responsibility until July 31, when ABC pays the dividends.

Cash dividends are the payments an organization makes to its shareholders as a return of the corporate’s profits. Paid on a per share basis https://cryptolisting.org/, solely the shareholders on report by a certain date are entitled to obtain the money payout.

By the time an organization’s financial statements have been released, the dividend would have already been paid and the lower in retained earnings and cash already recorded. In other words, buyers will not see the legal responsibility account entries within the dividend payable account. When a dividend is declared, the total worth is deducted from the company’s retained earnings and transferred to a brief legal responsibility sub-account called dividends payable. This means the corporate owes its shareholders money but has not yet paid. When the dividend is ultimately distributed, this liability is wiped clean and the corporate’s money sub-account is reduced by the identical amount.

However, after the dividend declaration and earlier than the actual payment, the corporate data a liability to its shareholders within the dividend payable account. If an organization pays inventory dividends, the dividends reduce the corporate’s retained earnings and increase the common Bookkeeping inventory account. Stock dividends don’t lead to asset adjustments of the steadiness sheet however quite have an effect on only the equity aspect by reallocating part of the retained earnings to the frequent stock account.

However, when an organization stories its quarterly results, the stability sheet solely reports the ending account balances. As a outcome, the dividend would have already been paid and the lower in retained earnings and money already recorded. In other words, investors won’t see the legal responsibility account entries. Cash dividends provide a typical method for firms to return capital to their shareholders.

As soon because the board of administrators for an organization declares a dividend in both money or inventory form, funds are faraway from the retained earnings account. If your small enterprise is rising at a wholesome fee and profits are rolling in, it may be time to declare a dividend and provide shareholders with both cash dividends or extra stock. Regular fee of dividends provides an incentive for additional investors to become stakeholders in your business and retains current stockholders pleased when occasions are good. The payment of both cash and stock dividends impacts the accounting equation by immediately reducing the quantity of retained earnings for the company.

For example, on March 1, the board of administrators of ABC International declares a $1 dividend to the holders of the company’s one hundred fifty,000 excellent https://cryptolisting.org/blog/why-administration-accounting-is-important-for-any-business shares of widespread inventory, to be paid on July 31. This remains a liability till July 31, when ABC pays the dividends.

If a inventory dividend is issued instead of cash, this represents a reallocation of funds between the additional paid-in capital and retained earnings accounts. This is simply What does apportionment mean in government? a reshuffling of amounts within the fairness section of the stability sheet.

Upon cost, the company debits the dividends payable account and credits the money account, thereby eliminating the legal responsibility by drawing down money. While the accounting equation is straightforward, many various accounts and funds can comprise assets and liabilities at a business. Examples include accounts devoted to workplace supplies, depreciation expense, pay as you go insurance coverage and utilities. Shareholders‘ equity is determined by including retained earnings and common inventory. When calculating retained earnings, dividends impact the balance of the account immediately.

How does the payment of a previously declared cash dividend affect the elements of the financial statements?

The dividends payable account recorded how much the company owes to shareholders between declaring a dividend and actually paying it. This account will be credited (increased) on the date of declaration. Like the debit to retained earnings, the amount credited will be the total value of the dividends declared.

What Is the Accounting Equation?

This requires offsetting accounting entries in different financial accounts with slight changes based mostly on the kind of dividend offered. When corporations bookkeeping earn income, they’ll either reinvest them or distribute them to shareholders in the form of dividends.

What Are Dividends?

How does paying dividends affect the accounting equation?

The payment of both cash and stock dividends impacts the accounting equation by immediately reducing the amount of retained earnings for the company. This requires offsetting accounting entries in other financial accounts with slight changes based on the type of dividend provided.

While cash dividends have an easy effect on the balance sheet, the issuance of inventory dividends is slightly more sophisticated. Stock dividends are sometimes referred to as bonus shares or a bonus problem.